Loan Amount:

₹5000 to ₹1,00,000 Lakhs

Annual Percentage Rate

(APR): 35% (Fixed)

Quick Disbursal:

Within 48 hours

No Collateral:

Paperless and hassle-free

Start with our quick loan application. It's simple and only takes a few minutes. Provide basic info,

After you submit your application, our system will go to work. We verify your details and make a quick decision.

Once approved, the funds are sent directly to your bank account. You can access the money immediately.

Life insurance offers lump sums or payments to help beneficiaries cover debts and expenses.

View More DetailsLife insurance offers lump sums or payments to help beneficiaries cover debts and expenses.

View More DetailsLife insurance offers lump sums or payments to help beneficiaries cover debts and expenses.

View More DetailsLife insurance offers lump sums or payments to help beneficiaries cover debts and expenses.

View More DetailsVEDANSH FINANCIAL SOLUTION PVT LTD

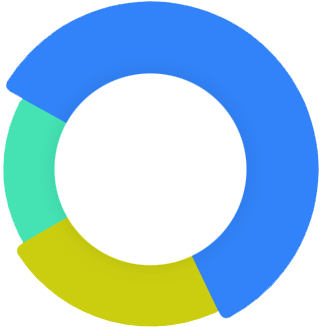

EMI Loan

Processing Fee 1 % APR 12%

Agriculture loan

Processing Fee NIL APR 6%

You have to

Pay: ? 5050

Processing Fee:

10%

APR:

486.67%

After submitting your application, we review it quickly. Our system processes applications fast,

After submitting your application, we review it quickly. Our system processes applications fast,

After submitting your application, we review it quickly. Our system processes applications fast,

NBFCs cannot accept demand deposits.

NBFCs do not form part of the payment and settlement system and cannot issue checks drawn on themselves.

surance facility of the Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in the case of banks.

Here's the list of documents that are typically required for a personal loan application from RupeeHype.

Photo Identity Proof: PAN Card

Latest salary slip

Aadhaar Card

Permanent Address Proof: Any one of the following: Passport, Driving Licence, Voter's Identity Card, or Utility Bills (e.g., Electric/landline phone bill, gas bill) that are not more than 2 months old

If the current address is different from the permanent address, then additionally: a utility bill (e.g., an electric or landline phone bill or a gas bill) of the current address that is not more than 2 months old, Leave and Licence Agreement/Rent Agreement

The latest statement of your Bank account shows your salary credit.

It's important to note that the loan amount you can borrow, and the repayment period can vary based on the lender and the type of loan. The information you have mentioned is specific to RupeeHype and may not apply to other lenders. It's always advisable to check with the lender directly or visit their website to confirm the specific loan amount and repayment period for a personal loan with them.

It's also worth noting that the loan amount you qualify for will depend on your creditworthiness, income, debt-to-income ratio, and other factors considered by the lender.

Clearly, no. We believe in our customers and have trust in them. Therefore, we do not require any collateral or security to be provided when applying for a personal loan. All we need are your valid documents to verify your eligibility.

We accept payments only through NEFT, IMPS/UPI/CHEQUES methods. To make a payment, please visit https://www.RupeeHype.com/repay-loan.

Please be sure to verify the accuracy of the above information before making any transfer. If you require any further assistance, please reach out to info@RupeeHype.com.

You can expect to receive your loan disbursed in a lightning-fast time, even faster than it takes for a pizza to be delivered to your doorstep, typically within 30 minutes or less!

© 2025 VEDANSH FINANCIAL SOLUTION PVT LTD. is a Non Banking Finance Company (NBFC) registered with the Reserve Bank of India (RBI). RupeeHype is the brand name under which the company conducts its lending operations and specialize in meeting customer's instant financial needs.